8 Ways to Improve Non-Compliance Communication with Insureds

June 10, 2021

Insurance Verification Challenges

Companies that deliver a Certificate of Insurance (COI) request to their franchisees or third-party partners are faced with a number of subsequent challenges, first of which is communicating the intentions and steps necessary to complete the verification process. If this isn’t done properly, it can be a key point of failure when attempting to verify insurance to reduce risk.

Insurance requirements often ask for proof of obsolete provisions or coverages that aren’t available anymore or have been incorporated into standard coverages. These provisions and coverages are not readily conveyed on standard COIs, and the terms used in these agreements don’t always easily map to standard COIs (e.g. There may be differences in how coverage types or limits are named).

The reason why insurance verification tends to halt at this point in the process is because indemnity agreements are written in complex legalese and insurance jargon that are simply too ambiguous for a layman to comprehend, which means the Insured is frequently forced to rely on their broker(s) to interpret and execute on the company’s coverage requirements.

The best way to remediate this is to over simplify communications to the Insured, and explain where their coverage falls short in ways they can understand. Here are our recommendations to provide better communication when the Insured is non-compliant with coverage requirements.

Recommendations for Non-Compliance Communication

1. Reiterate the requirements

-

- Make the insurance requirements easily accessible by providing a link to them directly in your communication, instead of forcing your Insured to retrieve the contract on their own

- Create a separate document with the insurance requirements that is isolated from the rest of your contract so that they can be shared with other parties (e.g. brokers & agents)

- Ideally, reformat the requirements into a checklist

2. Create a sample compliant COI

-

- Translates ambiguous contract language into an easily understood format

- Makes it easy for Insureds to compare their COI against the “gold standard,” even for non-insurance experts

- Can be easily forwarded to their broker

3. Reference specific position and wording in your contract

-

- To make your point both stronger and easier to consume you can incorporate specific wording from your contract or reference the position where the requirement is located

4. List what is expected or acceptable

-

- For coverage types use industry standard terminology and coverage forms identifiers (e.g. CG 00 01)

- For limits use industry standard terminology, ideally the predefined fields printed on standard COIs

- Underline the exact wording expected for the additional Insured, waiver of subrogation, and similar endorsements

5. List what is not acceptable

-

- If your requirements are misunderstood and you see recurring deficiencies communicate what is not acceptable

6. List their alternatives, if applicable

-

- If there are alternative ways for Insureds to become compliant, include them (e.g. if the automobile combined single limit is expected to be $1M, we can accept split limits if each and every is at least $1M.)

7. Highlight relationships

-

- Be sure to underscore any dependencies between requirements

- Example: If the general liability aggregate limit is expected to be at least $2M, with an additional $1M for every additional location, companies can indicate that it is also acceptable to have a $2M aggregate limit for multiple locations as long as the aggregate limit applies on a per location basis.

8. Involve brokers in the process

-

- For details not easily conveyed on a standard COI, e.g. confirming something hasn’t been excluded, reach out to brokers directly to get a direct confirmation

How Evident Helps

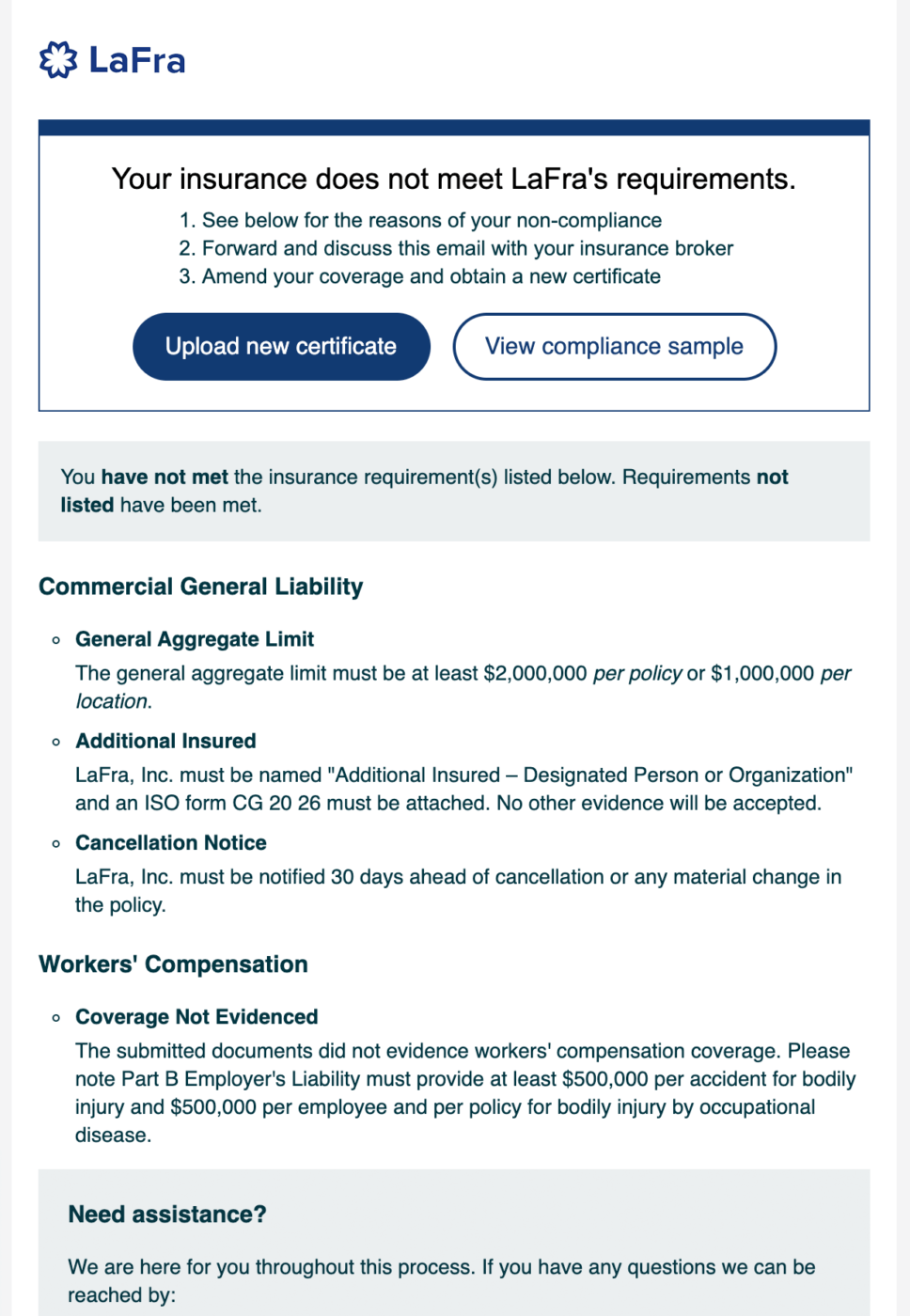

Evident’s insurance verification solution automates all of the above recommendations, making it very easy for Insureds to demonstrate compliance with corporate insurance requirements.

Our solution prominently links to and shares business’ insurance requirements and sample certificates in the form of a microsite or a document, and creates a detailed checklist that itemizes gaps in each coverage type and includes details on how to close them. We make it our business to equip the Insured with necessary information to work with their broker effectively.

Evident sources coverage information directly from brokers, agents, and carriers directly if the requirements call for non-standard COIs, and we partner with insurance brokers who offer compliant insurance.

Below is a sample email that our customers’ Insureds might receive in the event that they are non-compliant with their corporate standards.