COI tracking systems present a multitude of benefits for insurers, businesses, and external stakeholders alike. These systems are versatile tools that enhance the efficient management of insurance certificates.

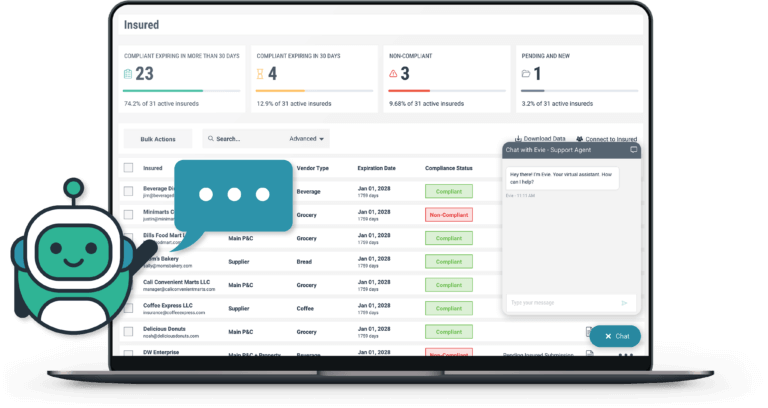

From the perspective of insurers, COI systems serve as cost-saving mechanisms that simultaneously elevate customer service quality. The automation of tasks such as COI collection, validation, and tracking translates to significant time and resource savings compared to manual procedures. Moreover, these systems substantially enhance the precision of COIs, mitigating the risk of errors that could potentially trigger disputes or insurance claims.

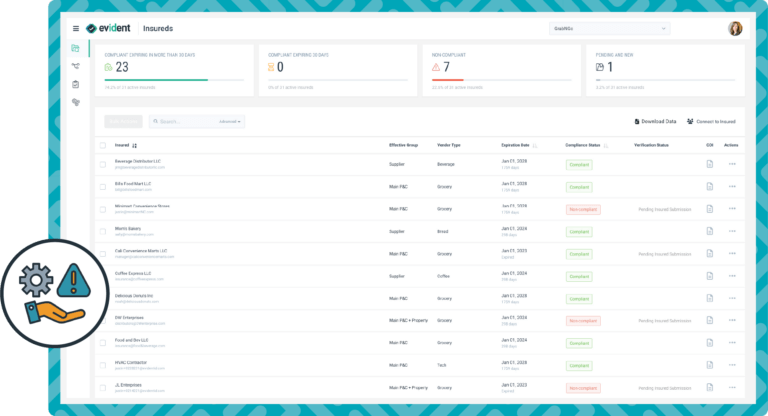

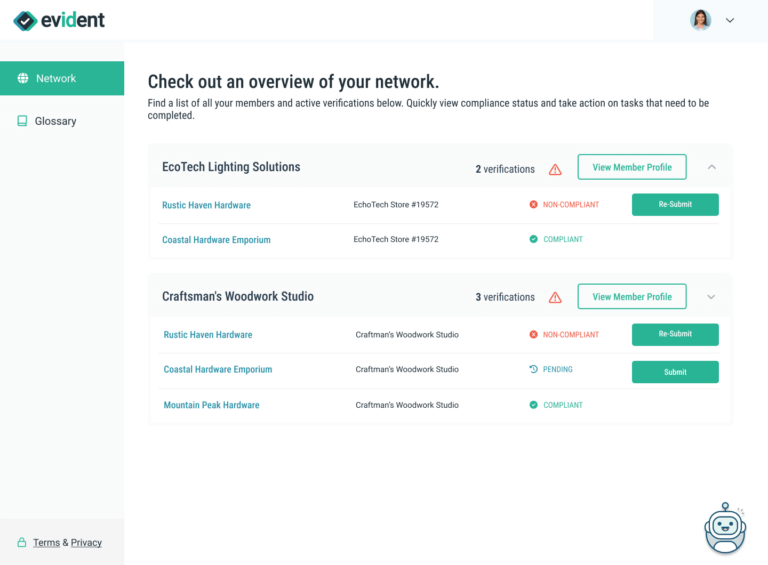

Businesses seeking to furnish evidence of insurance coverage to customers or partners also reap substantial advantages from COI tracking systems. Irrespective of their size, organizations can streamline the collection and verification of COIs through these platforms. This translates into time savings, reduced effort, and a diminished cognitive burden typically associated with the provision of insurance coverage proof. Consequently, businesses embracing COI tracking systems enhance their operational efficiency and reduce the likelihood of coverage gaps and oversights pertaining to their COIs.

For third parties, including clients, subcontractors, and vendors, COI tracking systems offer an expedited means of confirming insurance coverage. By requesting a Certificate of Insurance through a COI management platform, these external parties can swiftly and seamlessly validate the presence of essential coverage. This not only streamlines their own risk management but also diminishes the potential for disputes stemming from inaccurately verified insurance coverage, ensuring timely and precise compliance.