Transform Your Third Party Risk Management Program with Evident

With organizations increasingly relying on third parties, managing third party risk is a multifaceted challenge that requires a comprehensive approach. See how Evident’s Third Party Risk Management Platform revolutionizes the exchange of third party risk data to better inform your risk management program.

From managing regulatory compliance to reputation risk to critical operational and financial disruptions, risk managers are faced with the challenge of automating tens of thousands of data points within manual, clunky legacy systems. This leads to a simple, yet pervasive problem within risk departments. Limited resources mean that risk managers can only monitor a small percentage of their entire third party network.

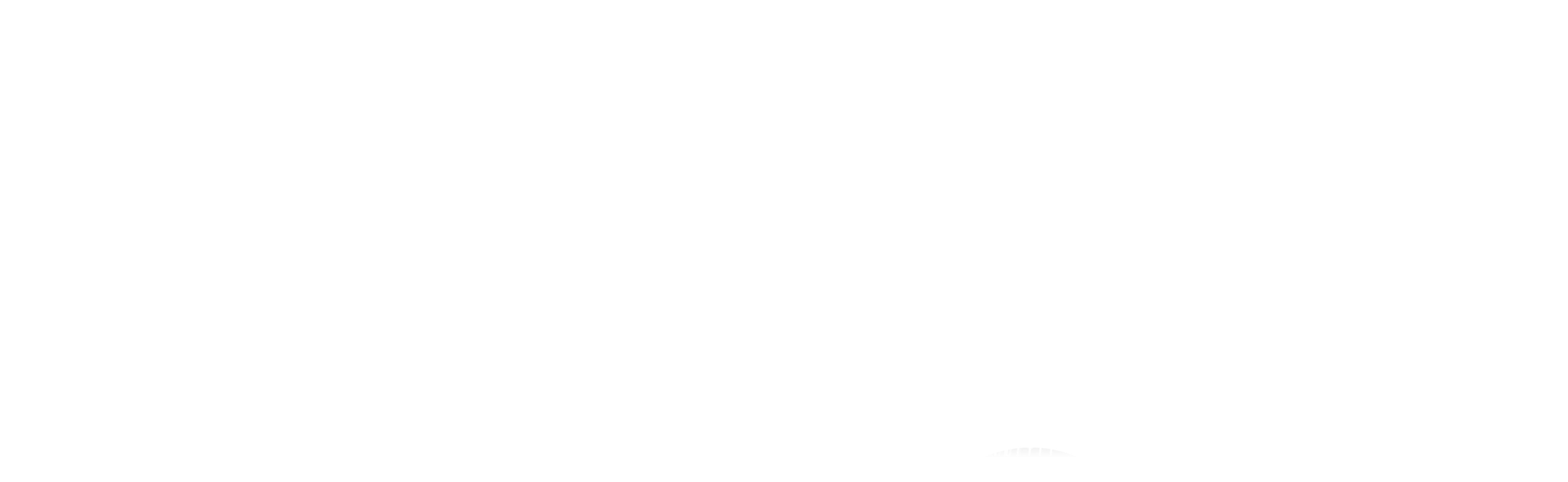

Intelligence in Every Phase of the Third Party Risk Management Lifecycle

Experience unparalleled reliability in validating third party compliance. We begin the due diligence process by identifying and gathering relevant facts across 30,000 data sources. We then compare them with your specific requirements or industry standards, ensuring a solid foundation for your compliance journey from the outset.

Our platform seamlessly integrates the review of submitted evidence, providing you with a comprehensive assessment of third party compliance.

Say goodbye to clunky third party risk mitigation processes and hello to centralized and highly configurable control over your third party requirements. Our automated system ensures seamless evidence collection from third parties, sparing you the headache of manual gathering and chasing down documents.

With Evident, onboarding has never been smoother. Thanks to our fully automated documentation collection, administrative burdens shrink by up to 90%, freeing your time for more strategic initiatives. Bid farewell to endless email chains and welcome a new era of efficiency.

Experience unparalleled confidence in validating your third party relationships with Evident’s meticulous diligence process. We kickstart your journey by delving into over 30,000 data sources, meticulously gathering and analyzing relevant facts. Each piece of information is then compared against your specific requirements, laying a rock-solid foundation for your compliance journey right from the start.

Because risks don’t fade away after onboarding, proactive risk management is essential for maintaining resilience and protecting your organization’s interests. Timely detection of risks allows organizations to implement proactive risk mitigation measures, such as strengthening security controls, enhancing due diligence processes, or diversifying their vendor portfolio.

With Evident’s continuous monitoring capabilities, you can stay ahead of the curve and navigate the complex landscape of third-party risks with confidence.

See how Evident's insurance verification solution helped 5F-SuperHighway achieve significant growth. They needed a comprehensive verification tool that could quickly evaluate a range of different credentials like proof of insurance, criminal history, business registrations, and other risk signals.

View Case StudyTransform Your Third Party Risk Management Program with Evident

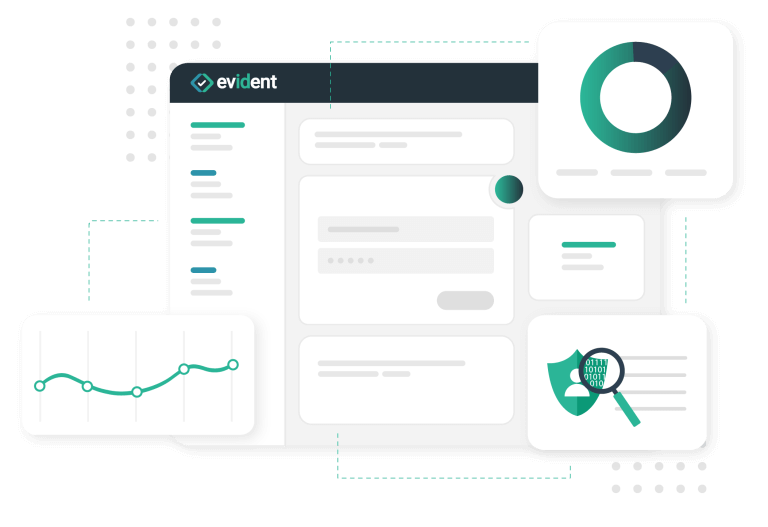

Evident’s Approach to Third Party Risk Management

Our risk management philosophy is to integrate data-driven insights, machine learning, and a configurable framework to proactively identify and mitigate risks while offering flexibility tailored to your specific requirements.