Join our network of connected in-force coverage data to fundamentally improve insurance verification, access low-cost growth opportunities, and write better risks.

Reduce Third-Party Risk with Automated Insurance Verification

The only fully-automated, fully-digital enterprise technology solution designed to reduce third-party risk, spend, and manual effort

Welcome Carriers!

Insurance Verification and Management, Reinvented

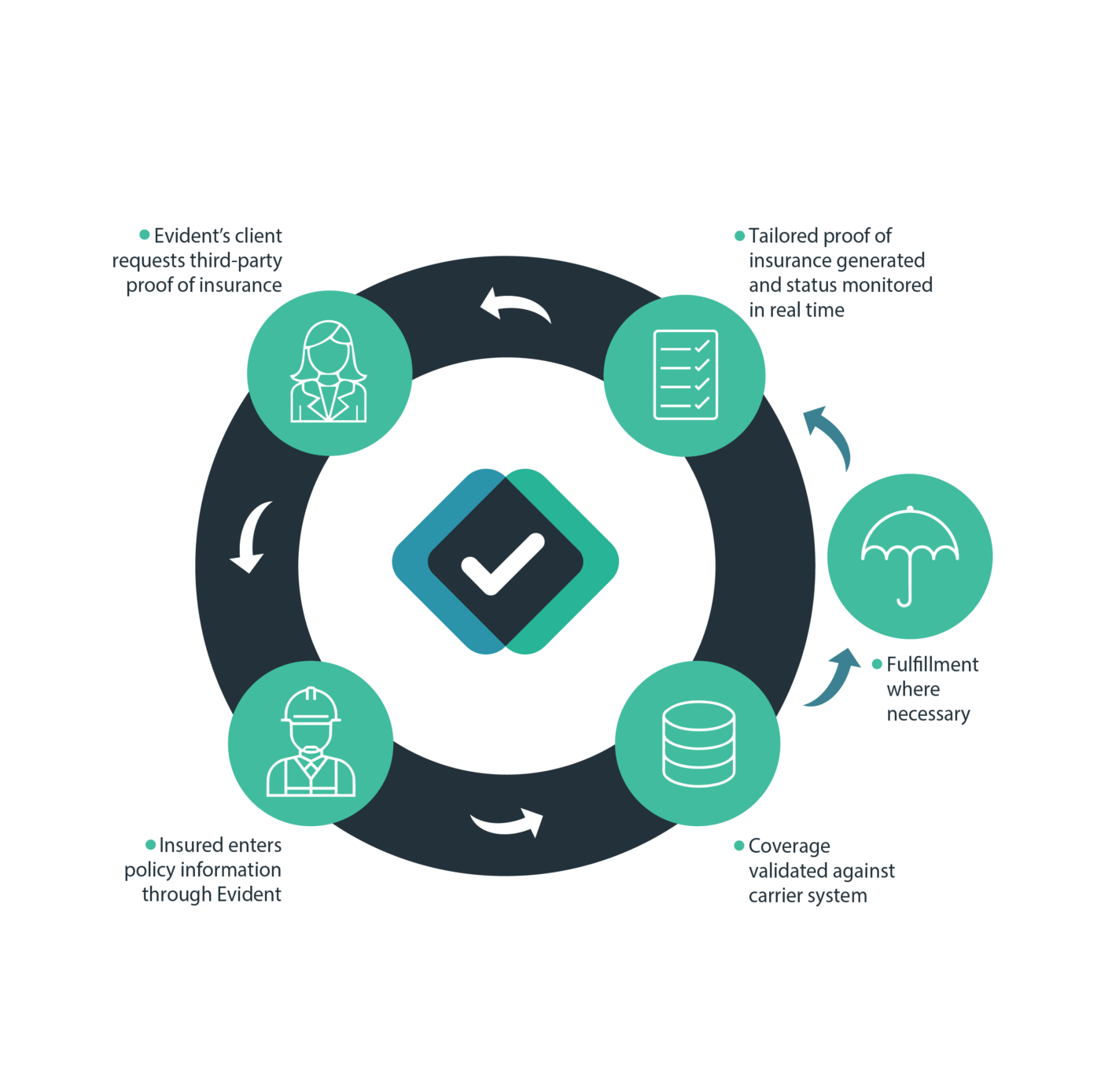

We're Evident. Our technology automates COI collection, digitization, verification, analysis, decisioning, and continuous monitoring to reduce our customers' third-party liability risks by improving their compliance rates. In fact, our enterprise customers see a 30-50%+ increase in third-party compliance within the first 6 months of implementation.

Partner with Evident

Every company has third-party insurance requirements, but the vast majority of third parties aren't compliant, and those coverage gaps can pose significant risks for enterprises. We're solving this problem by connecting enterprises to their third parties and insurers so we can automate their COI verification and offer them the exact right coverage they need to stay compliant with our customers' insurance requirements. Here are the two ways carriers can engage in a mutually beneficial partnership with Evident:

Semi-Integrated Connected Coverage

Evident will verify an insured's coverage against a periodically updated in-force extract. You'll be notified when your insured has a fulfillment opportunity.

Fully-Automated Connected Coverage

Evident will verify an insured's coverage against your CMS, and you'll be automatically alerted to any coverage gaps, policy servicing requests, and provided third-party risk data.

Brochure

Download our brochure to learn more about the benefits of partnering with Evident and what you can expect from us.

Grow Your Business with Evident

Our Customers

Large enterprises hire Evident to verify and monitor their third-party network coverage (average: 25K third parties with varied coverage requirements). We offer low-cost fulfillment opportunities when we identify coverage gaps.

Our Data

Evident will provide third-party relationship insights, entity resolution, advanced analytics, and the information required to rate a commercial lines policy.

Our Opportunity

Evident creates growth opportunities and operational efficiency through programmatic access to coverage data. By automating verification and closing coverage gaps, we can increase compliance for our customers and provide a better customer experience for all insureds.

The Benefits of Automation

Our Insurance Verification solution gives policyholders a real-time view into verification status and a better fulfillment experience by enabling carriers to automatically fill coverage gaps in third-party networks as they become visible. Automation reduces overhead and overall risk from third-party exposure, which keeps risk in its place – with the parties that are financially responsible for them.

The Benefits of Connected Coverage

Joining our insurance verification network makes it easier for carriers to measure, monitor, and mitigate the third-party risks of their policyholders, minimizing the financial impact of un- or underinsured third parties, and maximizing new business opportunities.