- Solutions

-

-

OUR SOLUTIONS

-

USE CASES

-

-

-

-

- Products

-

-

ONBOARDING

-

DILIGENCE

- For Vendors and SuppliersStreamline your verification process and mitigate potential risks

- For Local Service ProvidersAutomate and streamline your provider’s due diligence process

- For Activity ProvidersMeet the highest standards of safety, compliance, and reliability

- For Home SharingEnsure thorough host vetting and compliance

- For Care ProvidersEnsure care providers meet your standards

-

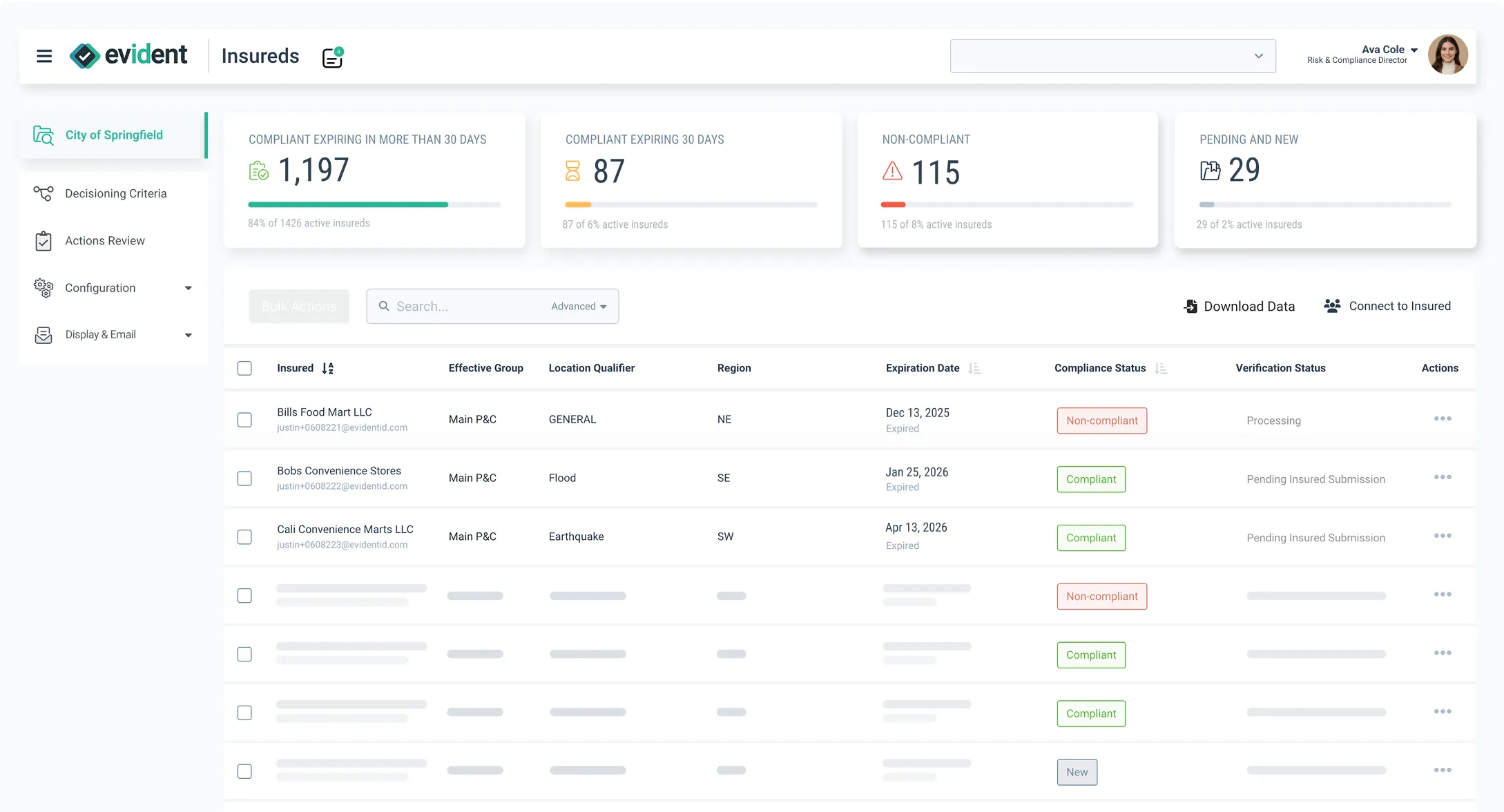

RISK TRANSFER

-

-

- Who Benefits

-

-

FOR TEAMS

-

BY INDUSTRY

-

-

-

-

- Pricing

- Learning Center

-

- Partners

- Support

- Book a Demo