7 Steps to Simplify the Broker-Submitted COI Process

August 17, 2021

COI Meaning in Business

Certificates of Insurance (COIs) are documents that summarize the coverage of one or more insurance policies of an Insured – a third party, employee, contractor, borrower, etc. – and are intended to reflect whether they meet a certificate holder’s requirements. These documents are specific to the needs of the certificate holder, which is typically a business or organization, meaning that two COIs for the same policy may look dramatically different.

COIs are produced by the Insured’s Agent, Broker, or Carrier, and are then given back to the Insured who submits it to the certificate holder for approval. This type of limited disclosure helps convey what coverage is needed without over-communicating details of the policy.

Challenges with this Approach

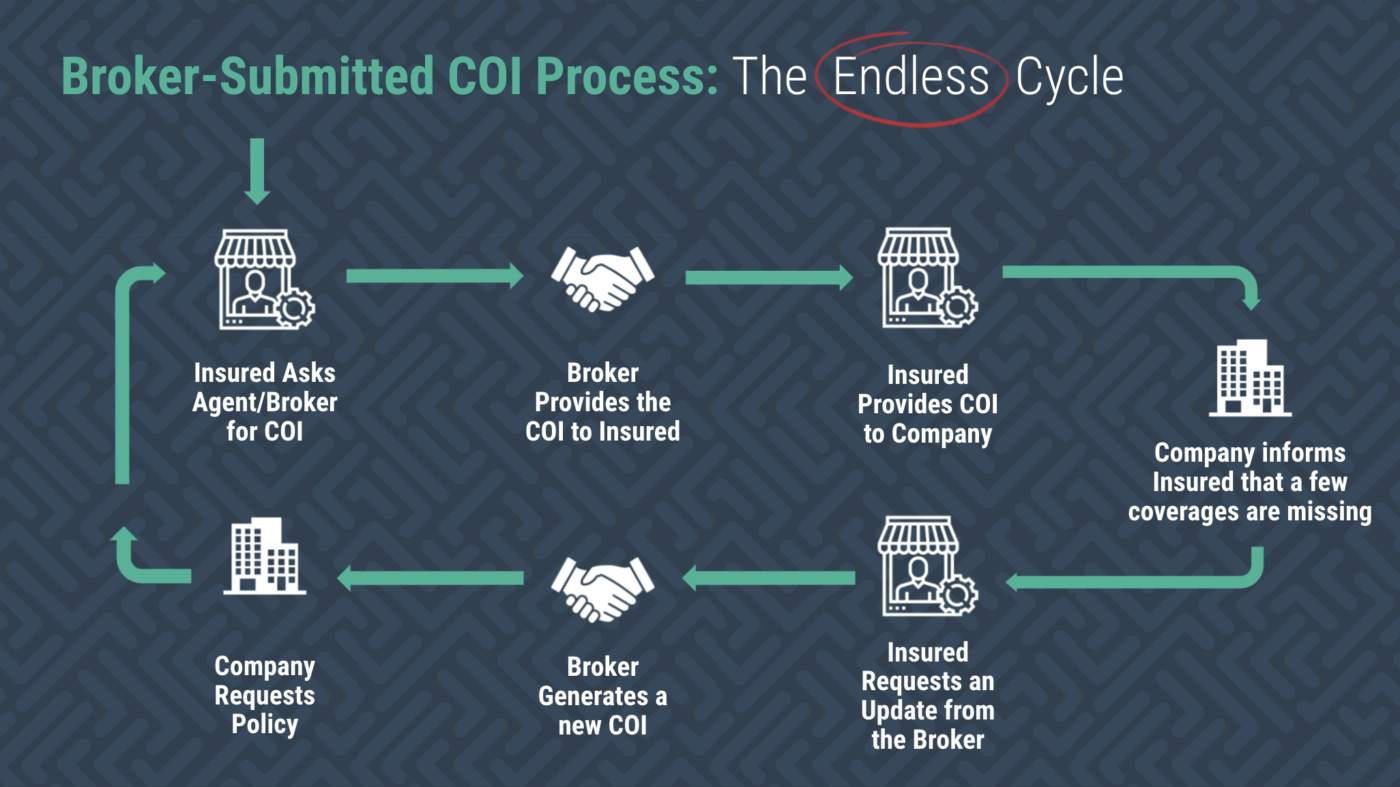

This approach may satisfy many, but far from all certificate holder’s needs, as it lacks criteria coverages about the Insured’s policy in question. Perhaps more importantly, the Agent and the Broker are very busy, so they can optimize the production of COIs by having good defaults for information that is communicated, but the net result is a high amount of back-and-forth, which is painful for everyone involved.

When an Insured isn’t overly knowledgeable in insurance subject matter, they’re unable to point the Broker in the right direction, and at some point – typically after they’ve created multiple policies and have still failed to convey whether the Insured is compliant with the business’ requirements – the Broker may try to find a contact within the business to determine what’s missing. As a result, they are unable to communicate the requirements sufficiently.

A COI is a nuanced document, and a third party may think the COI is a standard document, so simply requesting a COI will generate only what is required and not any additional information necessary to determine compliance.

COI Submission Pain Points

Submitting a COI is very time-consuming. The Insured is simply a middleman (or woman) in the flow, and even though they’re heavily involved in the process, they add no significant value in actually creating the COI. The business (certificate holder) ends up spending a great deal of time digesting and reviewing a COI, often receiving duplicates from the Broker or the Insured, while the overworked Broker spends so much time generating unclear or incomplete COIs that they become fatigued with multiple, confusing COI requests from the certificate holder.

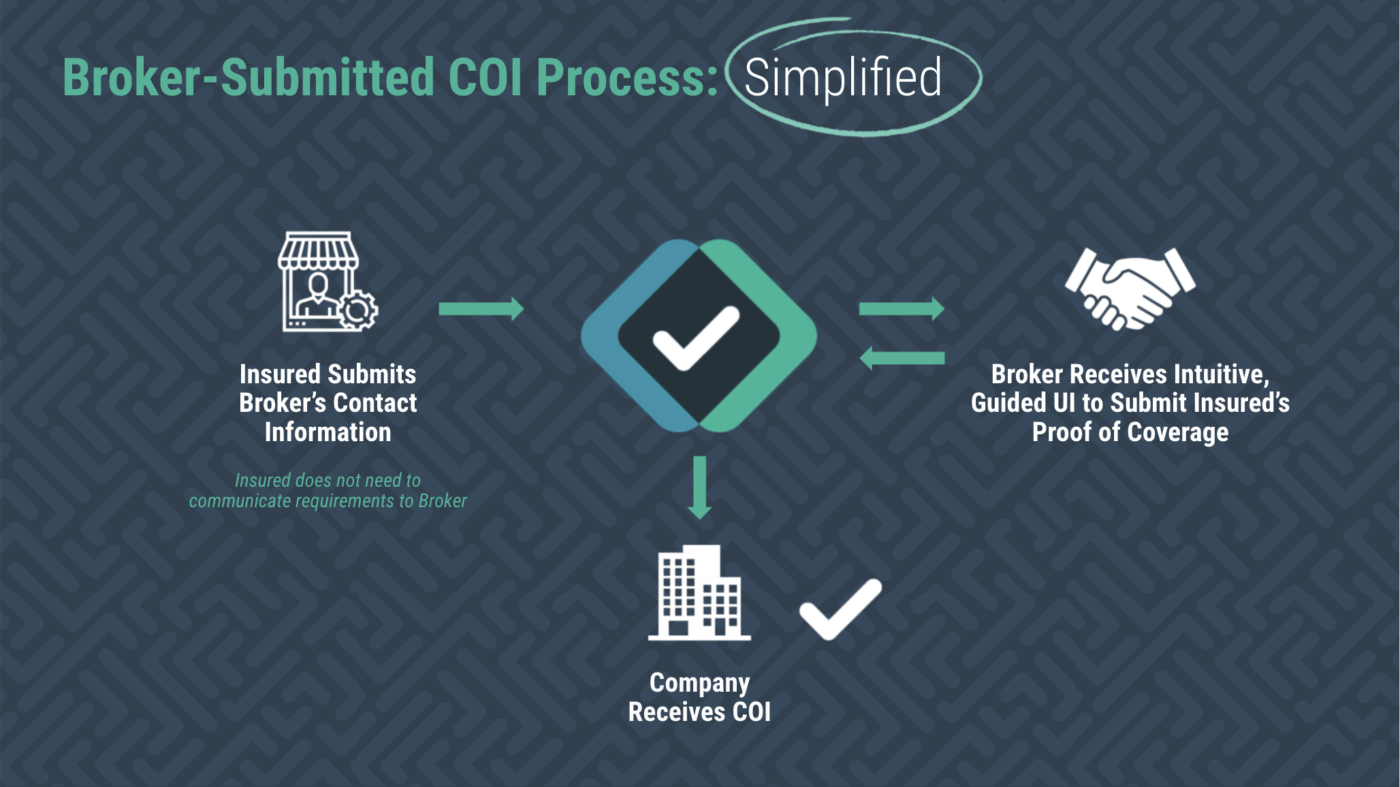

7 Steps to Simplify the Process

1. Offer clear and concise communication of requirements to the Broker

-

- Businesses shouldn’t just ask for a General Liability COI – they should ask for specific coverage limits, Additional Insureds status, and other significant details

2. Offer the Broker a method to verify that all requirements have been included, like a checklist, that way they have a quick inventory to note what is needed and then track what coverages have been included

3. Make sure COI requests are specific to the Insured, and not a “choose your own adventure” if you have multiple risk profiles

-

- For text fields: Be more specific about the “Additional Insured” or certificate holder language

- For coverages: List each specific coverage needed so the Broker doesn’t have to guess, and you don’t have to be lucky that the default is good enough, which is extremely important when you have nuanced or specific items you need to verify

- Include the limits so the Broker knows what values are expected

4. Offer direction on how the Broker can best respond

-

- If you want the COI sent directly, let them know how this should happen

5. Make it easy and clear for the Broker and the Insured to communicate when a coverage gap exists, and the reason(s) why

-

- It’s likely that you will have to take the Insured’s relationship into account, and having details proactively provided can save you time and reduce your overhead

6. Ensure that the Insured understands the implications of non-compliance to not only drive their response, but to actively close gaps to reduce risk and liability

7. Package this all up so your Insured can easily send it to their Broker