Upgrade Your Risk Management Tech Stack and Never Look at Another COI Again

April 22, 2021

There’s nothing modern about the standard ACORD 25 certificate of insurance (COI) –– they’re a headache to read and not hard to forge, but in order to maintain third party compliance, they have to be collected and verified by a risk manager… or do they?

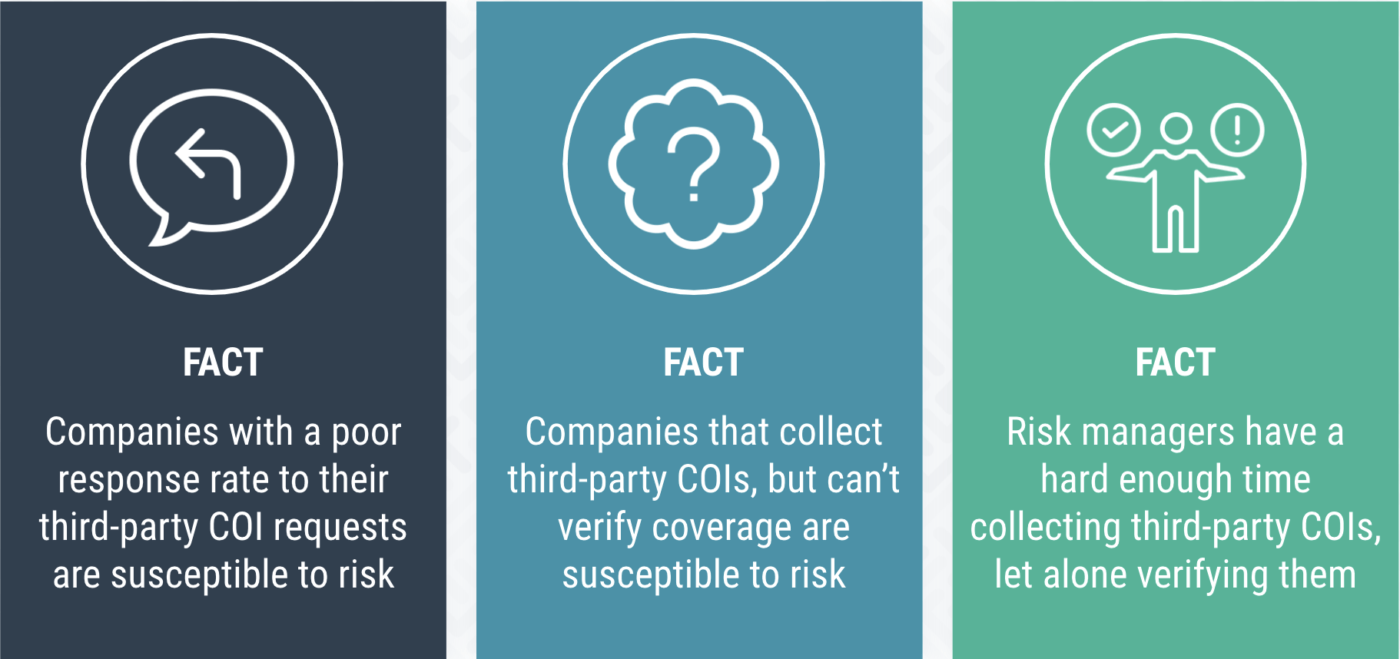

The burden of tracking down COIs from vendors, suppliers, business applicants, franchisees, and other third party partners typically falls on the shoulders of the risk management team, and while the goal is a 100% response rate on COI requests, the actual response rate is more like 30-40%, and of those who do respond to requests, the ones that are able to demonstrate compliance with the company’s insurance requirements make up an even smaller percentage.

Even if a risk management team is able to successfully obtain a COI, they’re either manually reviewing it themselves, or hiring someone else to do it. Either way, it’s an error-prone and inefficient process, and it’s only half the battle, because simply having the COIs on file is not enough to avoid liability. Risk, legal, and compliance teams also need to continuously verify that the COIs they’ve collected are valid, up-to-date, and authoritative.

Traditional methods for managing third party insurance risk are clunky and outdated… so, what’s the alternative solution? End-to-end automation. Risk managers that let COI tracking technology do the heavy lifting have a lot more time to spend examining and improving the insurance programs that they’ve been hired to manage.

Evident’s insurance verification solution leverages artificial intelligence and machine learning technology to automate the entire COI tracking process – from initial requests and continuous follow-up with Insureds, to certificate collection, verification, and ongoing monitoring, all with complete transparency so risk managers can better understand program gaps.

Evident is providing our customers with full visibility into their compliance program, and helping them do a better job of communicating with their third-party partners. Evident’s customers’ response rates on COI requests have gone from the 30%-40% range to the 70%-80% range, all within the first few months of deployment. (Download our research report)