Step Into The Future of Commercial Lending

March 9, 2023

Leverage AI/Machine Learning Technologies To Lower Costs and Increase Loan Approval Velocity

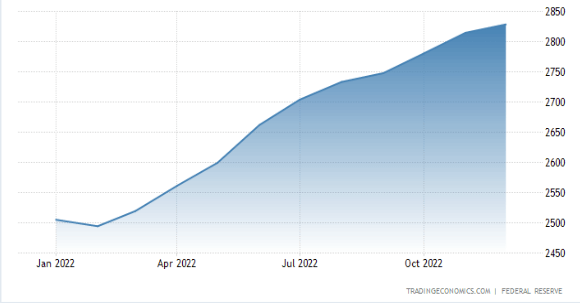

A recent study from Trading Economics has shown a dramatic rise in loans from 2.5 trillion dollars to 2.85 trillion dollars, over the last year.

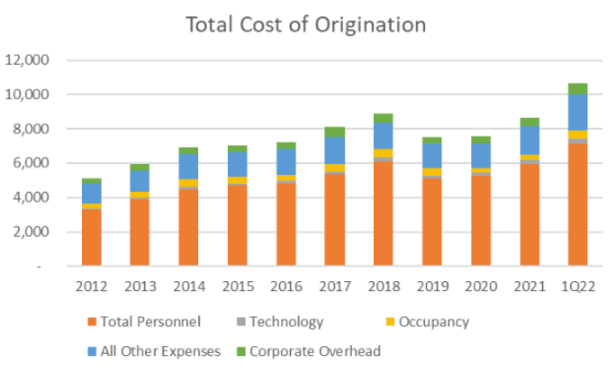

At the same time, the cost to originate these loans has also increased significantly.

- A decline in back office workers creates competition for talent to attract quality applicants

- Remuneration for these positions increased by more than 5% in hopes of attracting and retaining valuable employees

- Investment in technology innovation has stayed steady at 2% over the last few years

This trend of low investments in technology innovation with the increase in human capital cost is best summarized by Jonathan Coor, CEO of Ellie Mae “Our industry solves its issues with “human spackle.”

Loan origination costs may vary by institution and range from $9,000 to $19,000. For example, a $600K loan would cost an average of $11,300 including a decrease in costs from handling the loans that weren’t approved plus sales and marketing costs, and the cost of onboarding.

But these huge costs can be optimized by automating parts of these commercial loan origination processes leading to about a 23% reduction in costs.

How Can I Automate Commercial Loan Origination?

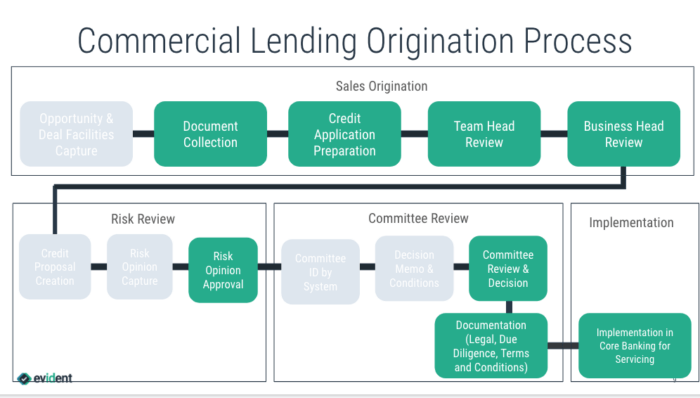

The commercial loan origination process includes the sales origination process, the risk review, the committee review, and finally the implementation of the loan.

Several areas can be dramatically optimized by automating and applying technologies such as AI and machine learning.

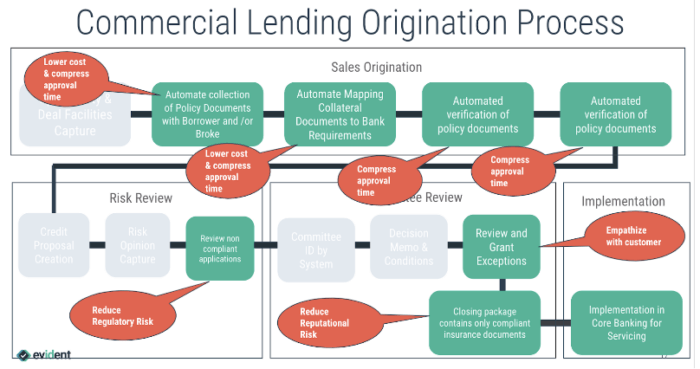

Machine learning can be used to learn about insurance policy documents and how best to extract the data from within those policies and then match that up against the underwriting criteria.

It not only increases efficiency but also improves accuracy and quality as it learns by collecting and handling more policies. It is generally a good first step for most banks to take before jumping into AI.

Leveraging AI, banks can create added efficiencies such as recommending policy coverage and requirements for the lenders.

It helps in eliminating human decisions and data entry from the process, ensuring fewer errors, and minimizing risks.

AI can go even further by incorporating insurance industry data that will show the probability of a claim, thereby allowing bankers to better manage their pricing and risks. AI can turn that data into increased profits and better risk management without intervention by humans.

How One Bank Cooperative Used Machine Learning to Reduce Admin Burden

A bank cooperative leveraged an insurance verification solution to achieve an 85% reduction in the administrative burden of verifying insurance and the accompanying cost savings.

There was a strong mandate to normalize the loan process across the institutions while still maintaining relationships with highly valued borrowers.

Thanks to automation, the loan process was sped up as applicants were able to quickly prove that they met the criteria for coverage and any exceptions were handled by staff.

How Evident Can Help

Commercial lenders can rely on Evident to provide efficient and accurate business insurance verification – and ongoing monitoring – that reduces administrative costs and manual processes. Evident also works with our broker partners to provide non-compliant borrowers with the exact right insurance to meet the lender’s standards, making it easier for them to get covered.

Evident automates the entire process – from collection, verification, and analysis, to decisioning, storage, and monitoring of coverage – to remove the burden of managing your borrowers’ compliance.