What is a COI? – An Insurance Expert Response

March 29, 2022

What is a COI (Certificate of Insurance)?

A Certificate of Insurance (COI) outlines how much coverage a potential third-party vendor’s policy provides up to a specific dollar amount, along with the types of incidents that are covered, the effective date, and the expiration date.

A Certificate of Insurance protects both yourself (the company) and your potential third-party vendor to ensure financial security, peace of mind, and a risk management solution before they start working together.

A good COI should be customized to the request. For example, if the third-party vendor is insured up to $5 million in liability limits, but you (the company) are asking for $1 million, the third-party certificate should reflect the $1 million.

A COI acts as a legal document that shows all stakeholders involved that they are properly protected by meeting the insurance requirements.

It also indicates that an additional insured has been added as listed, meaning any potential financial losses caused by them will be taken care of.

Therefore, understanding what a COI is and why it matters can be immensely beneficial for businesses.

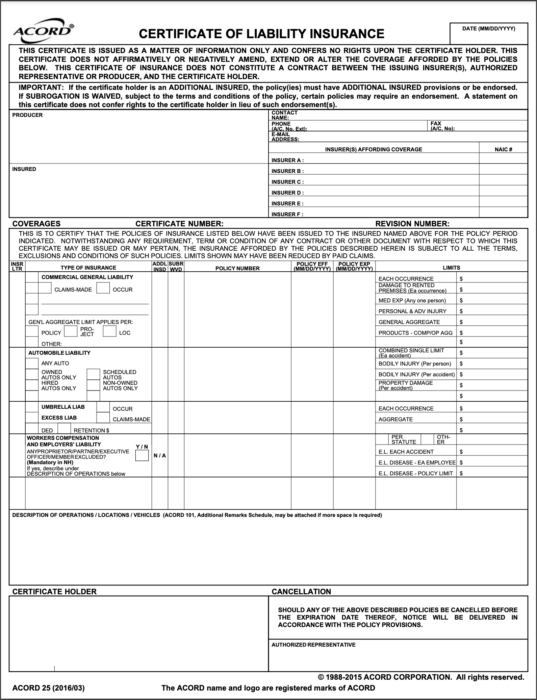

COI ACORD Form

The most widely used template is the ACORD form, which was developed to simplify communication in the insurance industry. So, make sure to get your hands on a certificate of liability insurance and show the world that you have the coverage you need to succeed.

What does a Certificate of Insurance typically include?

A certificate of insurance, or COI, is a document that includes basic information about an insurance policy.

This document typically includes the

- Insured’s mailing address

- Contact information for the insurance company

- Type of policy

- Policy effective dates

- Coverage limits

Additionally, any additional insured parties, such as other people or companies covered by the policy, will be listed on the COI.

For example, a COI for small business insurance might include details about general liability, commercial property, commercial auto, and workers’ compensation insurance.

As a certificate holder, your name and contact information will also be included on the COI. If you request a COI from another small business owner, they are required to notify you of any policy cancellations.

Identifying Types of Coverage in a COI

From liability to workers’ compensation, there are numerous types of COIs—making it crucial businesses maintain a diligent tracking process that assesses document legitimacy, adequate protection, and expirations.

Certificate of Liability Insurance

A Certificate of Liability Insurance (CLI) is a powerful tool that can save you from financial turmoil in case you accidentally cause damage or harm.

Rather than providing you with another piece of paper, a CLI is a concise summary of all the insurance coverage that you have in relation to a specific task or project.

It contains all the necessary information about you, your producer, and your carriers. Having a CLI is crucial, especially when clients ask for it to ensure that they are working with a reliable and responsible individual or company.

The coverage options that a CLI includes are:

- General liability, which covers damages or injuries caused by you or your employees

- Auto insurance, which covers accidents that you may cause while driving

- Workers compensation, which pays for any injuries or illnesses that your employees may sustain while on the job

- Umbrella or excess coverage provides additional protection beyond what your underlying policies offer.

So next time you’re asked for a CLI, remember that it’s much more than just a piece of paper – it’s a shield that could protect you from financial devastation.

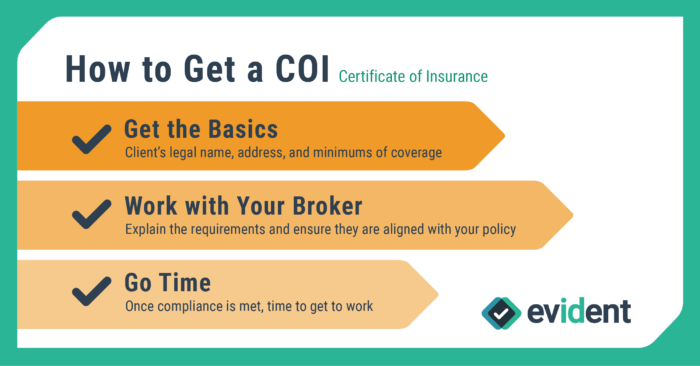

How to Get a Certificate of Insurance

Be sure to share these three steps for your third-party vendor.

- Get the Basics: Your client’s full legal name, address, and tax identification are easy things to miss during the COI process. This is also a good time to make sure you are on the same page in terms of what the minimums and limits of the coverage should be.

- Call your Broker: Since you are on the same page with the company. Now is the time to explain what the requirements are with this company and that you need proof of insurance.

- If you already meet the policy requirements, then the Broker will provide the COI.

- If not, your broker will provide the appropriate paperwork and details to ensure you (the third-party) are compliant and meet the requirements.

- Signed, Sealed, and Delivered: All requirements are met? Send your signed COI to the company and complete the transaction (and get to work).

Although this process seems straightforward, budget for delays. Getting an approved COI can take days or even weeks, depending on the bandwidth of each individual player in this chain.

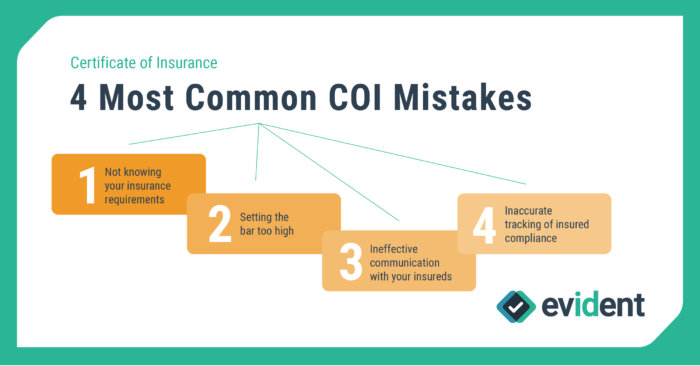

4 Common Certificate Of Insurance Mistakes

Having business insurance is important, as it proves to potential customers and partners that you’re a serious firm that’s taken the proper steps to protect your business and provide peace of mind to others.

We have outlined the 4 common COI mistakes:

- Not knowing your insurance requirements

- Setting the bar too high

- Ineffective communication with your insureds

- Inaccurate tracking of insured compliance

Not Knowing Your Insurance Requirements

As with any other insurance product, your business insurance is catered to specific data a vendor provides. When securing business insurance, vendors need to be mindful of standard expectations based on their industry.

For example, it’s not uncommon for retailers who are screening product vendors to ask for a COI that offers at least $1 or $2 million in total coverage. But if you only secure a policy that offers $500,000, this will automatically disqualify your business.

Setting the Bar too High

Likewise, for the client requiring a COI, opting for excessive coverage requirements can backfire. While these higher requirements provide better protection for your business, they can also mean that good vendors won’t be eligible to work with you.

Excessive coverage might translate to exorbitant policy premiums that are unsustainable for overhead expenses.

Ineffective Communication With Your Insureds

With an average of 23 compliance criteria, it can be challenging to communicate all of the requirements.

If you’re still relying on manual communication methods or disparate and clunky document-uploading services, it’s no wonder you struggle to stay on top of compliance.

Inaccurate tracking of Insured Compliance

Having access to a vendor’s COI is only relevant if you’re keeping track of compliance and expiration. If your system doesn’t automatically flag when a COI offers insufficient coverage or a policy is about to expire, your business is now exposed to liability.

What is COI Management?

Simply put, COI management allows businesses to easily vet, track, and update COIs from multiple vendors in one straightforward automated system. Helping you minimize risk while ensuring that all data is stored properly for easy access.

Why is COI Tracking Important

If you’ve been relying on manual methods of filing COIs and contacting vendors for updates, it’s time to embrace the digital transformation revolution. Old-school methods can pose serious liabilities when critical information falls through the cracks. Opting to automate can save your business headaches and liabilities.

1. Higher Productivity

Compliance is important, but unless your business is specifically for buying or selling insurance, it’s not what’s driving revenue. You need your staff to focus on the tasks that create profit. An automated COI compliance solution gives you peace of mind while also freeing your team to tackle other essential tasks.

2. Increased Collaboration

Relying on manual outreach to gather COIs or receive updates is slow and clunky. In some cases, an email might not be on file, or it could be incorrect. Worse still, stilted back-and-forth communications can delay vendor onboarding and sales projections.

With pre-programmed follow-up emails, you can ensure a better response and relationship with your vendors.

3. Greater Insights

From seeing a sharp decrease in vendor compliance to realizing that perhaps you’re asking for more coverage in certain areas than you need, automation allows you to be more agile.

4. Centralized Data

Distribution is great for retail products and workforces, not so much for information. Disparate systems have always been and will continue to be a recipe for disaster. When all of your data is in one central location, it’s easier to keep track of pending deadlines and vendors that need to submit further verification and achieve a better overview of potential liability.

Discover the Best COI Tracking Software

Say goodbye to tedious COI tracking spreadsheets and manual tasks. Investing in a platform that streamlines COI management and ensures coverage across clients and vendors is essential. That’s where Evident comes in. Our cloud-based solution features a top-notch COI software and a team of dedicated insurance professionals who understand legal frameworks, contract language, and the complexities that come with managing COIs.

Our software incorporates automated checks and balances, providing your team with insight into key decision points.

Our easy-to-use technology and unparalleled support make us the best COI tracking software on the market. However, we encourage you to do your own research to determine the best solution for your needs. Request a free demo to learn more from our experts and get started on your path to compliance today.

Evident’s Certificate of Insurance Solution

When your system is streamlined, everyone wins — including your vendors. Gone are the days when your compliance team was juggling between systems to find COIs or sending batch and blast requests for documentation or contact information updates.

When you leverage a system that allows you to automate the review, approval, and data collection processes for COIs, you can maintain more robust relationships with your vendors.

Evident is an automated insurance compliance out-of-the-box service designed to help vendors, insurers, and enterprises coordinate and streamline the insurance verification and compliance process. Take the guesswork out of managing complex vendor relationships.