5 Ways to Improve Your COI Tracking Process

January 28, 2021

Are you a risk manager trying to stay on top of your certificate of insurance (COI) tracking process?

Risk comes in many forms and is often difficult to quantify. Assessing risk from third parties that you do business with is even more challenging. Verifying insurance is the best way to mitigate that risk – but it’s not easy. In fact, it’s manual, complicated, and frustrating, with too many moving parts.

COIs are an essential part of effective risk management and can help protect your company from liabilities. However, making sure all relevant information is accurate and up-to-date can be long and laborious.

This blog post will explore five tips for improving the efficiency and effectiveness of your COI tracking process. Read on for more insights into how streamlining this process could save you time in the long run!

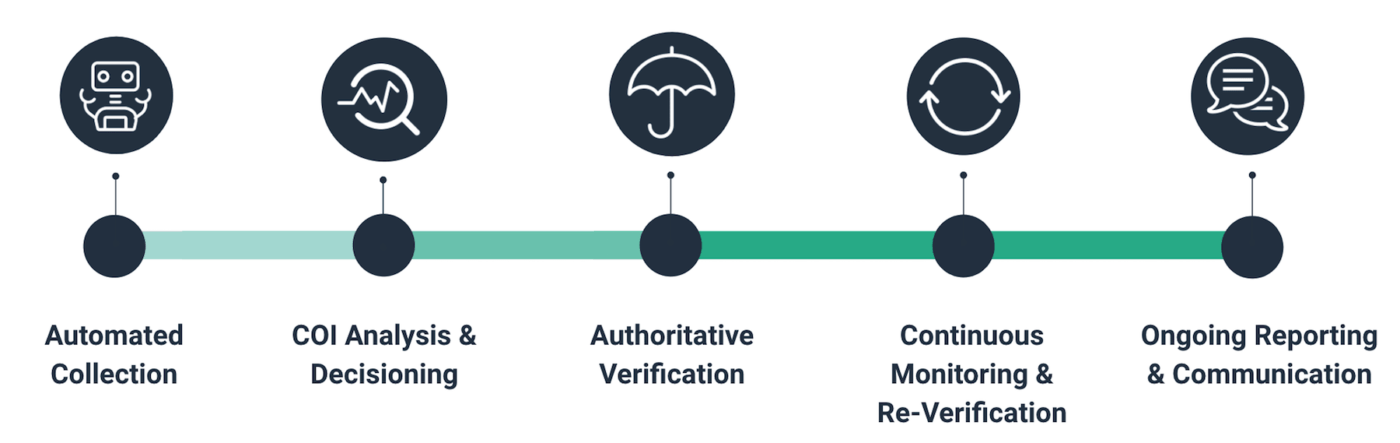

Automate COI Collection

When managing certificates of insurance (COI), automation can make a world of difference. Automated software solutions help streamline COI tracking processes, making it easy to access important documents and promptly communicate changes with vendors.

Taking advantage of this technology means faster and more reliable response rates, increased efficiency through automated renewal notices, and reduced manual paperwork.

By implementing an automated COI tracking system, organizations can raise their standards and save valuable time in the long run.

Automate COI Analysis & Decisioning

To get the most value from collecting certificates of insurance, companies need tracking software that will help them with their COI verification.

A COI tracking software will look at insurance coverage to identify gaps and determine the business’ overall risk and its potential clients.

Reliable Insurance Verification

Companies are looking to automate their compliance management.

Compliance should reflect actual types of coverage not just the presence of a COI. Are the coverage amounts correct? Do they have business insurance?

A quality solution should have a central office of information to ensure small business owners to enterprises have the right insurance carrier.

Continuous Monitoring & Re-Verification

Keeping track of your vendors and subcontractors’ certificates of insurance can be a complex process. By setting up alerts when COIs are expiring or need to be renewed, will allow real-time visibility.

This allows you to ensure that you are always compliant and not caught off guard by unexpected expiration dates. Setting up alerts is an essential part of a comprehensive certificate of insurance tracking process.

Ongoing Reporting & Communication

If you’re looking to gain a more comprehensive understanding of your organization’s certificate of insurance status, create custom reports.

Now you’ll be able to see detailed insights for your vendors and subcontractors and their COI status.

By taking advantage of custom report generation for better analysis, organizations can:

- Save time

- Save resources

- Gain more accurate information about their COI status

An easy-to-use dashboard is also great for companies to stay organized and maintain regular contact with their partners, vendors, franchisees, etc.

Following these 5 steps will help to improve your Certificate of Insurance tracking process and make it more reliable and efficient.

- Implementing automation

- Setting up alerts

- Centralizing data

- Creating custom reports

- Integrating with other systems

If you want to take your COI tracking process to the next level and enjoy the benefit of improved compliance and accountability, reach out to our team today. With Evident’s cloud based COI tracking solution is designed with all of these features in mind to help you easily manage each step of the process.