The Importance of Engaging Your Insureds

September 28, 2021

Insured Engagement Overview and Best Practices

The data from Evident’s latest research report, The State of Third-Party Insurance Verification, revealed that engaging with Insureds was a substantial challenge for businesses. In fact, nearly a quarter of requests for proof of insurance went unanswered. Among the factors contributing to this problem were unclear communication of requirements, insufficient processes for supporting and managing relationships, and an overall lack of adherence to outreach best practices.

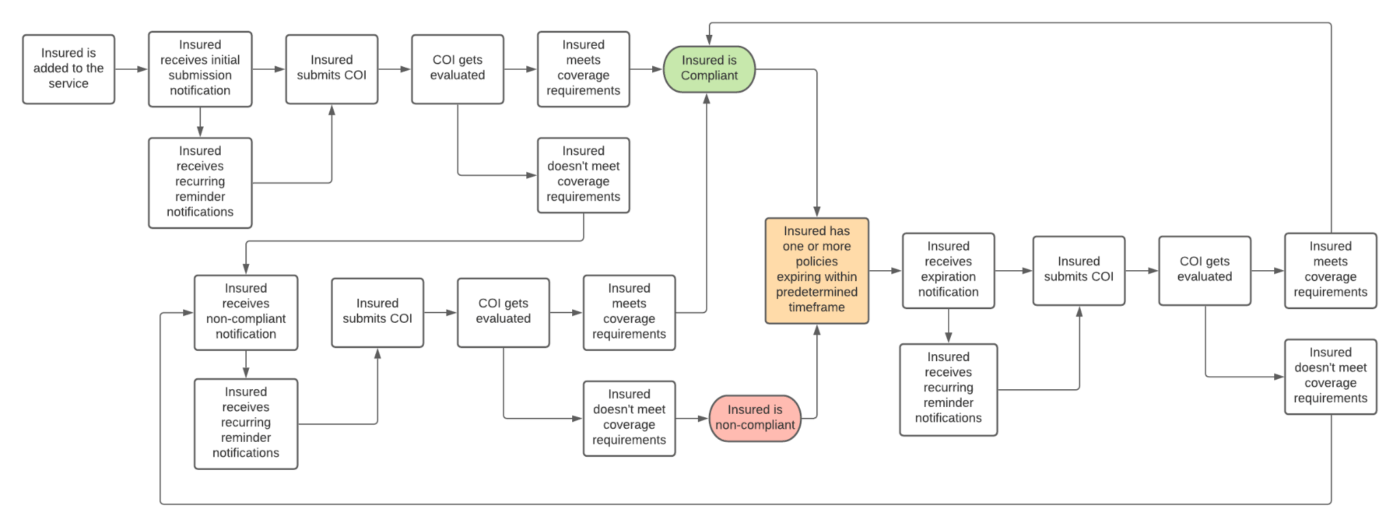

This flowchart outlines an optimal third-party insurance verification process:

Why Engagement Matters

Engagement is critical for an insurance verification program to be successful. The first hurdle is getting your Insureds to respond to a COI request. For the Insured to respond, they must receive something to view, read, and take the requested action (upload a COI). Beyond merely sending email communication, interaction is also expected, so you’ll need to properly set up the process to support the bidirectional nature of engagement.

Response rates are only one piece of the puzzle, however. Consider a scenario where your entire Insured population responds to your request, yet none of them provide sufficient documentation. Would this accomplishment be considered adequate? Ultimately, in addition to achieving high response rates, engagement with your Insureds should also be geared toward ensuring successful conversion.

There are many ways to demonstrate proof of insurance coverage, and not all COIs are the same. COIs are created to reflect the specific Coverage Types and Coverage Fields of interest for the certificate holder. As such, several drastically different COIs can be generated for the same coverage, each dependent on what the certificate holder is requesting to see—because of this, being mindful of how you relay the information needed from your Insureds is a critical component of the engagement process.

Effective engagement is also crucial for your population of Insureds, as insurance verification processes can become cumbersome for them without proper due diligence. Clarity is the hallmark of a positive Insured experience, and achievement of both is measured by initial success. Without sufficiently clear and consistent communication, the Insured is unlikely to provide documentation that meets your needs.

Ambiguity or frequent back-and-forth between you and your Insureds – stemming from either a misunderstanding of requirements or from requirements being perceived as unreasonable – will result in a negative experience for all parties involved, ultimately leading to reductions in conversion and response rates alike.

High rates of response and conversion are integral for increased compliance and ensuring that you and your Insureds have a positive insurance verification experience. Evident’s Insurance Verification solution will help you achieve these goals quickly and efficiently by adhering to our engagement philosophy principles.