Risk Transfer: 3 Examples Retail Owners Should Be Aware Of

July 11, 2023

We are going to walk you through three incidents that can result in lawsuits for a retailer.

While it may not always be possible to avoid legal action, risk transfer can minimize costs and keep your insurance premiums more affordable. Discover practical ways to protect your business and assets

- Let’s explore a case involving a laundromat and a hefty insurance claim of $500,000. A tenant who runs the laundromat had not listed the property owner as an additional insured, leading to inadequate liability insurance coverage. Unfortunately, a customer slipped on ice outside the building and experienced a severe leg injury. As a result, a reserve amount of $500,000 was required due to the seriousness of the incident. Learn from this case how to ensure proper insurance coverage and protect your business from costly claims.

- In this next scenario, a property owner leased a parking lot to a company for vehicle parking. While an employee of the tenant was loading a truck, they fell into a hole and suffered severe injuries from the material being loaded onto them. Though the tenant’s workers’ compensation carrier paid for the loss, they later subrogated against the property owner’s insurance company as the lease didn’t specify a subrogation waiver requirement. This led to a settlement claim of $3,750,000, which covered the expected costs of future surgeries and lost wages.

- Let’s take a look at another real-life example of a warehouse-related claim. Here’s the scenario: the owner of a warehouse building hires an HVAC contractor to fix the AC system and replace some of the ductwork. During the repair process, the contractor leaves HVAC materials outside the building, causing a customer to trip and cut their arm. Unfortunately, there was no contract in place that could have protected the building owner from liability. As a result, the building owner’s insurance carrier is now facing a lawsuit from the injured party, and the reserve for the claim has been set at $50,000. It’s a clear reminder of the importance of having proper safeguards and contracts in place to protect against unforeseen incidents.

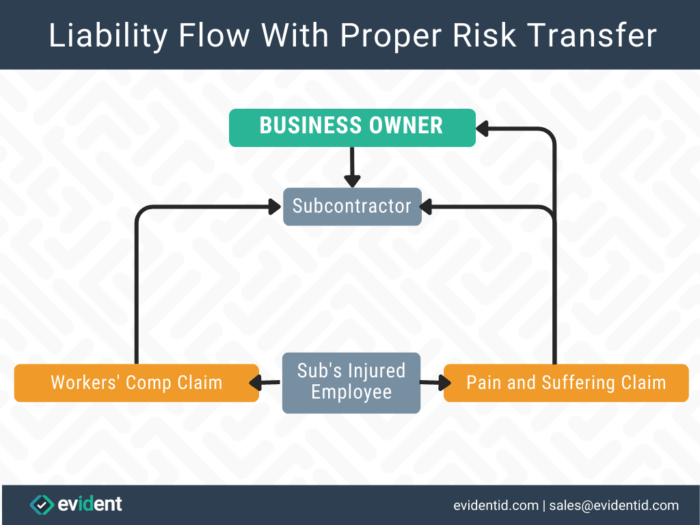

These are common, everyday problems that we see all the time. By using proper risk transfer for liability claims you can better protect yourself with these 8 steps.

- Hold Harmless and Indemnification Agreements, and How to Protect Yourself

When you hire a subcontractor to perform work for your business, it’s important to have a hold harmless and indemnification agreement in place. This agreement specifies that the subcontractor will hold you harmless for any losses that may arise as a result of their work. But be careful – in some states, these agreements are considered void if they require the subcontractor to accept responsibility for the sole negligence of the hiring contractor. Other states have anti-Indemnity laws preventing Indemnification for even the active negligence of the hiring contractor, allowing Indemnification only for passive negligence.

One way to ensure your agreement is valid is to include what’s called “saving language.” This phrase usually refers to the phrase “to the fullest extent permitted by law,” as seen in our example. This language helps ensure that the subcontractor will defend, indemnify, and hold harmless the property owner and property manager, and their agents for whom the work is performed.

But what about your subcontractor’s injured workers? In some states, their obligation is limited to workers’ compensation benefits. To protect yourself, consider including an Indemnification for you from the subcontractor when their employee is injured on your job. Remember, it’s important to have a well-written agreement in place to protect your business from potential losses.

- General Accepted Provisions

To ensure both parties involved are protected in work agreements, it’s important to include two provisions: a hold harmless/indemnification provision and an insurance requirements/additional insured status provision. These provisions should be detailed in any work order, purchase order, contract, or similar document, and specify that beginning the work signifies acceptance of the agreed-upon terms. For service work done over a period of time, it’s essential to include in writing that these provisions remain in effect unless otherwise agreed upon in writing.

- Additional Insured Coverage and Minimum Insurance Requirements and Limits for Subcontractors

As a risk management professional, it’s crucial to ensure that your subcontractors have adequate insurance coverage. When selecting a subcontractor, make sure their general liability, auto, and umbrella policies provide additional insured status for ongoing and completed operations on a primary and non-contributory basis.

Be aware that some subcontractors may purchase insurance from non-standard insurance carriers to save money. However, this can lead to gaps in coverage, particularly with liability obligations like employee injuries. If a subcontractor lacks adequate coverage, your liability exposure increases, and insurability problems can arise. Consult with your agent or broker to make sure your subcontractors have the necessary insurance coverage and limits.

Additionally, it’s essential to confirm that your subcontractor carries workers’ compensation coverage. If not, their employees’ wages could be added to your payroll, and you would be responsible for their injuries. Ensure that your subcontractor (if an individual or partnership or corporate officer) has elected to be covered by the workers’ compensation policy as allowed in the particular state. Protecting your business and employees is crucial, so take the necessary steps to secure appropriate insurance coverage for your subcontractors.

- Make it a requirement that the subcontractor’s insurance responds first

It’s important to ensure that a subcontractor’s insurance is responsible for any losses that occur on your worksite. After all, the subcontractor has control over their own work and the safety of their working environment, making them primarily responsible for any accidents or damages that may occur. To ensure this responsibility is clear and legally binding, it’s crucial to state in the contract that the subcontractor’s insurance (including general liability, auto, and umbrella coverage) must respond first – on a primary and non-contributory basis. By making this requirement clear, you can protect your own insurance coverage and avoid unnecessary expenses.

-

-

- Include Subcontractor Obligations in Your Contracts

-

In order to protect your business from potential losses caused by subcontractors, it’s essential to ensure that all requirements and obligations stated in your contracts also apply to any parties hired by your subcontractor. By including this provision, you create an extra layer of protection that extends to all parties involved. Don’t leave your business vulnerable – make sure to state this requirement clearly in your contracts.

-

-

- Certificate of Insurance

-

Before subcontractors can commence work, they must provide your firm with a Certificate of Insurance. This certificate serves as evidence that the subcontractor is maintaining its own General Liability and workers’ compensation insurance. It should cover a significant liability loss with sufficient limits. The certificate should show the GC as well as the business owner as an additional insured for ongoing and completed operations on a primary and non-contributory basis.

It is also necessary to ensure that the subcontractor’s insurance policies are endorsed, providing you the right to notice of cancellation as allowed by local state regulations.

A certificate of insurance summarizes the coverage in force at the time it was issued, providing evidence that certain insurance requirements have been met. However, it does not necessarily guarantee the policy to be in effect at the time of the loss.

It is essential that no subcontractor is allowed to enter your premises without first providing an up-to-date certificate of insurance. The ACORD Certificate of Insurance form has become the industry standard, providing a brief summary of the coverage in force.

Remember, a Certificate of Insurance does NOT serve as a guarantee that the policy doesn’t contain additional exclusions/coverages. Additional insured status is a backup to the indemnity agreement and is only effective in certain cases if required by a written contract or agreement.

Protect your business by ensuring all subcontractors provide you with a Certificate of Insurance.

-

-

- Waiver of Subrogation

-

In order to protect your business and ensure that your subcontractors are on board, it’s important to have a clear understanding of the waiver of subrogation. Essentially, the subcontractor should agree to waive their right to seek payment from you for any damages that are covered by their insurance policies.

This can include general liability, auto, umbrella, and workers’ compensation policies. In addition, especially for workers’ compensation, the waiver should also require the subcontractor to waive their insurer’s right to be reimbursed by you in the event that a loss occurs as a result of your negligence and to provide a policy endorsement as proof of such. By incorporating clear and concise waivers of subrogation into your subcontractor agreements, you can help to protect both your business and your subcontractors from potential disputes and financial losses.

-

-

- Safety Program Requirements

-

Keeping workers and visitors safe is a top priority. That’s why it’s important to require subcontractors to follow the same safety guidelines as your own employees. By including this requirement in your contract, you’ll send a clear message that safety is non-negotiable. And let’s not forget – an accident-free work site is not only a reflection on your business, but it also impacts your insurance premiums and reputation. Keeping everyone safe is a win-win for everyone involved.